All these measures are aimed at providing a liquidity of Rs. 3.74 lakh crore in the system

Separately, RBI has permitted the banks, NBFCs, Housing Finance Companies and other financial institutions to allow a 3-month moratorium on payment of installments on term loans.

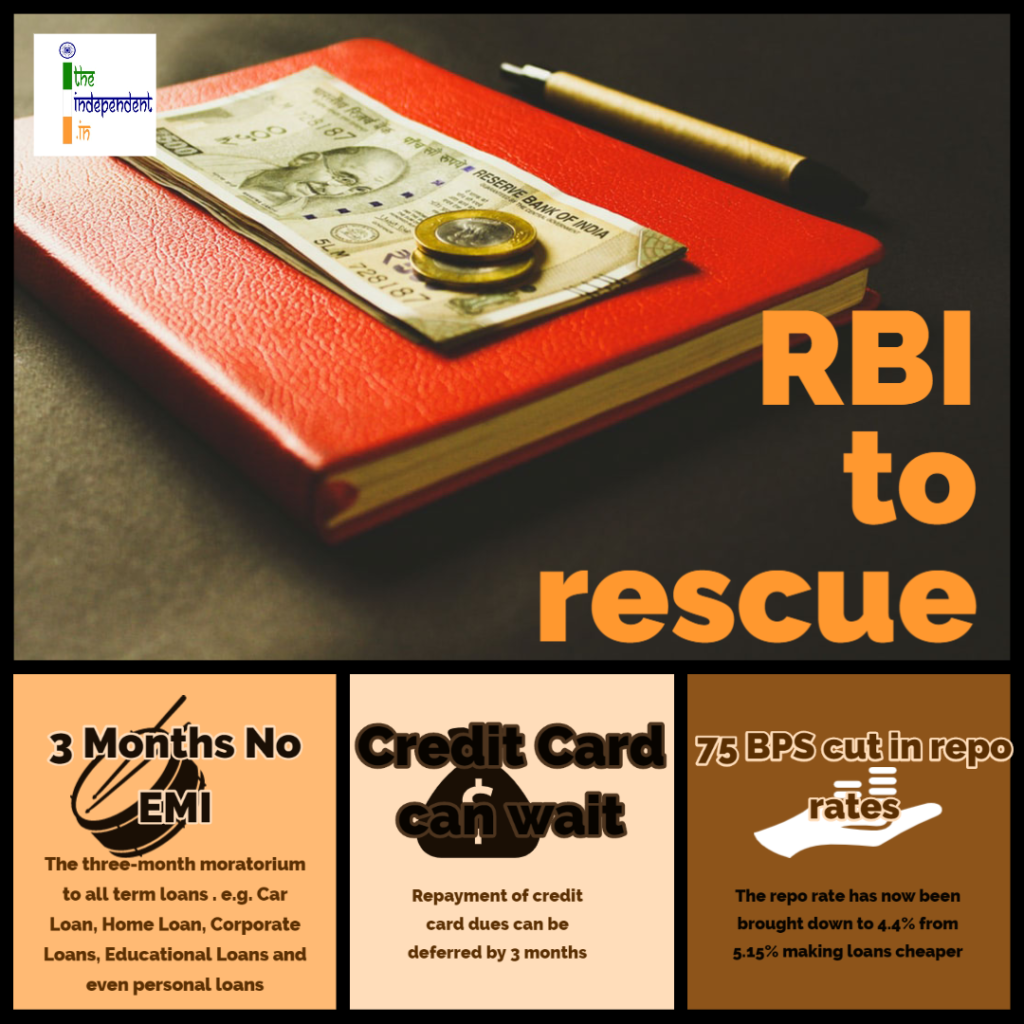

In a slew of measures directed towards combating the economic impacts of Coronavirus (COVID-19), the Governor of Reserve Bank of India (RBI) – Shaktikanta Das, today, i.e., March 27, 2020 announced a massive 75 Basis Points (BPS) cut in repo rates and a moratorium of 3 months on EMIs.

The repo rate refers to the rate at which the RBI lends money to commercial banks in the event of any shortfall of funds. It is used by monetary authorities to control inflation.

Making the announcement in a Press Conference, Das said that the repo rate has now been brought down to 4.4% from 5.15%. The decision was made after the Monetary Policy Committee (MPC) voted 4:2 majority to cut repo rate by 75 BPS. The MPC had held its meeting a week ahead of the scheduled date.

Speaking on the occasion, Das said, “This decision of the rate cut and the advancement of MPC have been warranted by the disruptive force of COVID-19. It is intended to mitigate the negative effects of the virus, to revive growth and to preserve financial stability.”

Commending the RBI’s move, the Prime Minister of India tweeted, “Today @RBI has taken giant steps to safeguard our economy from the impact of the Coronavirus. The announcements will improve liquidity, reduce cost of funds, help middle class and businesses.”

The reverse repo rate has also been cut by 90 BPS to 4% to make it unattractive for banks to passively deposit funds with the RBI and instead lend it to the productive sectors. The RBI highlighted the fact that the pandemic will impact the growth of most of the sectors owing to its intensity, spread and duration.

Terming the situation as uncertain, Das added, “Projections of growth and inflation would be heavily contingent on the intensity, spread and duration of COVID-19. The MPC has refrained from giving out specific growth and inflation numbers because the situation is changing, and the outlook is uncertain.”

Das also signalled a possibility of global economy going into recession. The RBI will also conduct auctions of Long-Term Repo Operation (LTRO) of up to 3 years tenure of appropriate sizes for a total amount up to Rs. 1 lakh crores at a floating rate linked to the policy repo rate. The liquidity availed by banks under the scheme must be deployed in investment-grade corporate bonds, commercial papers and non-convertible debentures, over and above, the outstanding level of those investments in these bonds, as on March 25, 2020. The investments made under this facility will be classified as Held-To-Maturity (HTM) even in excess of 25% of the total investment permitted to be included in HTM portfolio.

He also announced to reduce the Cash-Reserve-Ratio (CRR) of all banks by 100 BPS to 3% of Net Demand and Time Liabilities (NDTL) with effect from March 28, 2020, for a period of 1 year. This reduction would facilitate primary liquidity of about Rs. 1.37 lakh crores uniformly across the banking system in proportion to liabilities of the constituents rather than in relation to their holding of excess Statutory Liquidity Ratio (SLR). In addition, the RBI has also reduced the minimum daily CRR balance from 90% to 80%. The accommodation under the Marginal Standing Facility (MSF) has also been increased from 2% of the SLR to 3%. It will be applicable upto June 30, 2020.

All these measures are aimed at providing a liquidity of Rs. 3.74 lakh crore in the system.

Separately, RBI has permitted the banks, NBFCs, Housing Finance Companies and other financial institutions to allow a 3-month moratorium on payment of installments on term loans.

The 3-month moratorium will apply to corporate loans, home loans and car loans. Personal loans will also qualify for this. The deferment will not impact credit history of the borrower. However, the lending institutions must put in place a Board approved policy in this regard.

Lauding the decision of RBI, the CEO of NITI Aayog – Amitabh Kant tweeted, “Way to go: Progressive & timely measures by @RBI @DasShaktikanta’s by giving 3 month moratorium on payments of term loan instalments (EMI) & much-desired relief on interest on working capital. Slashing Repo Rate & reverse Repo Rate will infuse liquidity. Big, bold steps.”