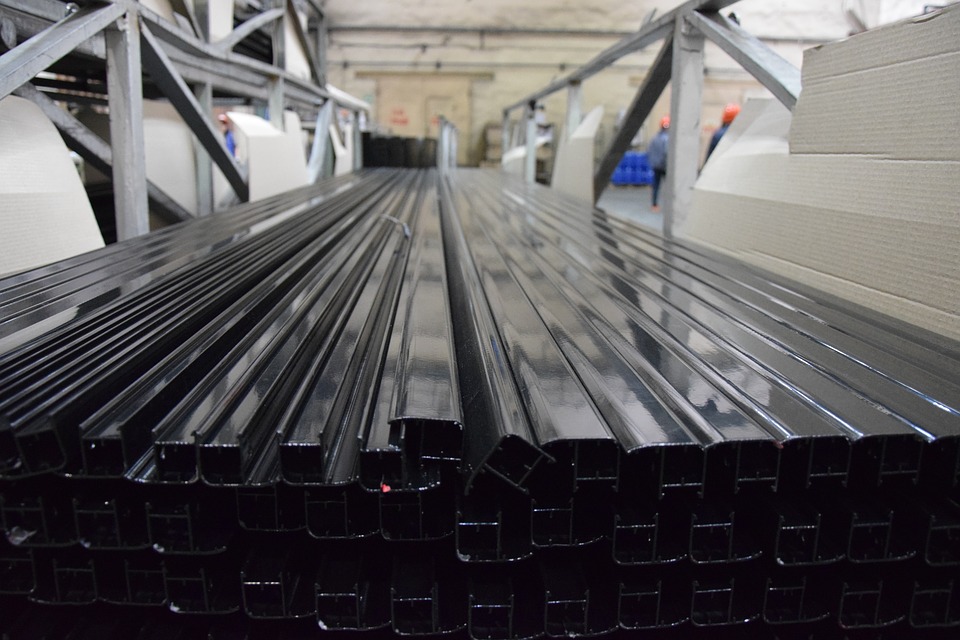

President Trump said yesterday that he would impose stiff imports duties on steel and aluminum. While delivering on yet another campaign promise, the decision is rattling stock markets as trade war clouds gathered.

The President of US, the country which has always promoted free trade said “(he) would impose tariffs of 25 percent on steel and 10 percent on aluminum, effectively placing a tax on every foreign shipment of those metals into the United States”.

President, describing his measures in details said that no country, exporting to US would be exempted.

While for most this may seem like an onset of trade war with China, the decision is going to hurt Australia and Canada as well.

The expected hike in input costs of all products and their packaging had everyone from Car Manufactures to Beer makers suggest price hikes.

Canada — the biggest foreign supplier of steel to the U.S. – has threatened US to be dragged to World Trade Organization, calling the step ‘unacceptable’. The European Union too is looking to “react firmly” with World Trade Organization-compliant escalations.

Bloomberg suggests that U.S. move on tariffs is provoking retaliation from China, the world’s biggest steel and aluminum producer. China has already launched a probe into U.S. imports of sorghum, and is studying whether to restrict shipments of U.S. soybeans — targets that could hurt Trump’s support in some farming states.

The protectionist measures of Trump without a detailed out long-term policy may start a trade war that goes well beyond just the US. As more and more countries build tariff walls trade and commerce will suffer with smaller nations suffering more than the larger ones. While its impossible to predict the unpredictability of the US president, the hike in import duties may well signal a new age of protectionism in Washington DC.