Demonetisation – surely not the voice of nation

One year after Prime Minister Modi made an economist out every single adult of a billion citizens of India, we find ourselves in the same rut that PM promised to eliminate. Yes while over 100,000 shell companies have been clamped down but no major punitive action has been taken against anybody.

When we stood in lines, begged for essential goods – on credit, we all did believing that tomorrow will be a better India. We were told that in a once a life time move every penny in this country will be accounted for.

That was not to be the case – for all the clamp down, the resourceful Chartered Accountants discovered new ways of converting the cash. Quite a few made one hell of a fortune (upto 30%) for converting Cash to Bank accounts and then another 10-15% by converting it again into cash. The conversions were so wide spread that the clamp down seemed to have people who were actually queuing for their hard earned money.

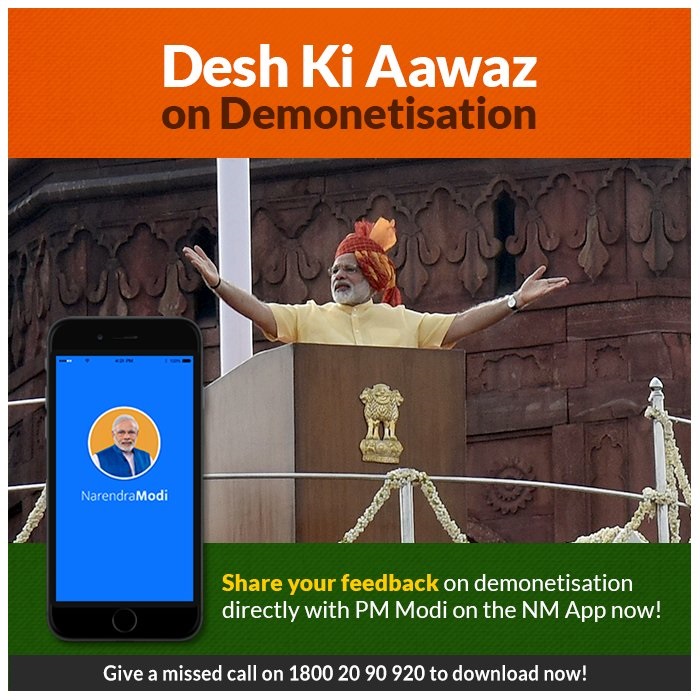

However the Prime Minister has a different opinion. Have a look at his tweet below:

125 crore Indians fought a decisive battle and WON. #AntiBlackMoneyDay pic.twitter.com/3NPqEBhqGq

— Narendra Modi (@narendramodi) November 8, 2017

Claim: Cash deposits of Rs 3.68 Lakh Crore in 23.22 Lakh accounts under suspicion

Reality: It only means more heyday for tax officials. These are accounts for which tax officials will send letters for clarifications. CAs will file answers – most justifying these as agricultural incomes, with fake/backdated receipts from Agri societies. The Tax inspectors will accept the answer after a small cut.

Claim: Decisive blow to terrorism and naxalism. Stone pelting incidents reduced by 75%, incidents of left wing extremism down by more than 20%

Reality: Yes the stone pelting is down and NIA has done a hell of a job in tracking down the sponsors and restricting them. Rajnath Singh should be proud. However PM is giving the credit in wrong place. Even without the demonetization NIA could have done the same thing.

Claim: 50,000 bank accounts belonging to 35,000 companies caught transacting 17,000 Crore after demonetization

Reality: No one has been caught. At best notices have been issued – and this is a subset of the first claim above. Also as per the claim in this very advertisement this is just 4% of suspicious transactions (Seventeen Thousand Crores as a part of 3.68 Lakh crores under suspicion) so hardly worth it.

Claim: Big push towards better job for the poor

Reality: With joblessness and overall slowdown, we did not even wasted our time to match the ESIC data with actual job creation data. Putting selective data points to provide a hollow defense against a well-founded criticism seems to be the new normal with the Modi Government

The truth is that the government agencies now have a full list of tax evaders, but they are toothless to do anything about it. The economic incentives to evade taxes still outweigh the possibility of prosecution and the black money continues to be created. The only way to use this money is to create an environment where it can be invested back into the economy. Albeit the finance minister is hardly the one thinking like that.