As Finance Minister Arun Jaitley gets ready to present India’s Budget on February 1 next year, he is taking up an uphill task. While Demonetization destroyed much of wealth in Q4 of last year, its reporting in Q1 of this fiscal will weigh heavy on tax collections in the period. Then the disruptions in Q1-Q2 just before GST when companies liquidated their stocks – at a discount would not escape the discrepancy in the estimated vs real tax collection. The post GST era itself is legendry in temrs of complete lack of data between actual tax collection, tax reclaim receipts and the state-central share of the treasury collections.

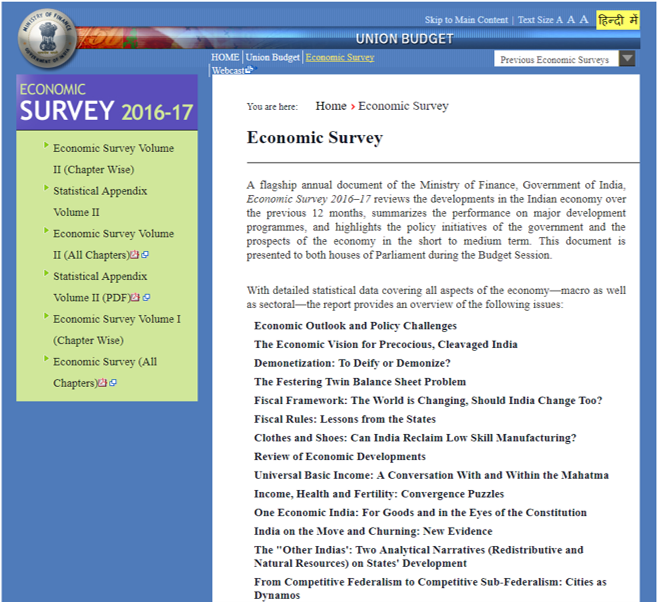

As per the present schedule the Economic Survey will be tabled on January 31, followed with the Union Budget the next day. Given its the last chance for the present Modi government to present a full term Budget before 2019 general elections, its expected that finance ministry is asked to consider populism. However given the lower tax receipts as discussed above, it would not be an easy task.

At any rate the previous budget’ revenue estimates had made provisions and estimates based on Service Tax, Central Excise, Customs etc. The same cannot be directly mapped to GST, hence, itcan be argued that there were no targets to miss. Further as the data collection exercise would have had been completed by November mid. This implies that only 3-4 months of post GST data would be captured. This would leave actual revenue achievement in economic survey, a bit of fairy tale fantasy.

While the finance minister juggles numbers to finance Bharatmala, Bank Recapitalization and populist policies, Prime Minister Modi may be forced to think if he should have gone ahead with GST at least a year earlier or not at all.